ESG analysis and consideration have become an increasingly important factor in the investment process. Investors worldwide are incorporating a multitude of ESG data at different angles into their investment process to gain a wider understanding of the companies in which they invest.

What Is ESG Investing?

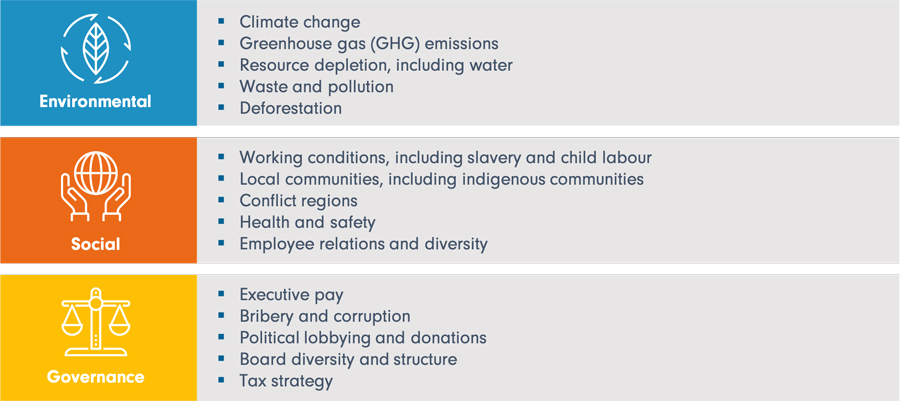

ESG stands for Environmental, Social, and Governance. ESG investing is the consideration of environmental, social and governance (ESG) factors, alongside financial factors, in the investment decision-making process. Globally, investors are increasingly applying these non-financial factors as part of their analysis process to identify material risks and growth opportunities. MSCI – the world’s largest index provider has started ESG related data since 1972 with its first index launched in 1990 and company rating launched in 1999.

ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report. Numerous institutions, such as the Sustainability Accounting Standards Board (SASB), the Global Reporting Initiative (GRI), and the Task Force on Climate-related Financial Disclosures (TCFD) are working to form standards and define materiality to facilitate incorporation of these factors into the investment process.

Different labels like sustainable investing, socially responsible investing, ethical investing, and impact investing all form part of ESG investing, with ESG factors covering an extremely broad range of issues – from avoiding investing in tobacco companies to financing clean water initiatives.

The concepts underpinning ESG have evolved over time.

While a hundred years ago, responsible investing was mostly about religious beliefs influencing the choice of investments, it’s now about people’s perceptions of themselves and their role in society informing their investment framework. ESG investing’s beginnings were largely based on exclusion – avoiding the asset classes and sectors deemed to have a negative effect on society – however, in recent years it has extended to modern-day activism, where investors directly intervene to enact positive change.

Today, ESG is considered by some as an asset class and an investment approach in its own right. Investor motivations for pursuing ESG vary widely, ranging from the already mentioned moral and religious beliefs to regulatory and legislative requirements, public and client pressure, and economic reasons.

ESG Investing Trends

As ESG investing accelerates in demand, several key trends are emerging – from climate change to social unrest. The coronavirus pandemic, in particular, has intensified discussions about the interconnectedness of sustainability and the financial system.

Looking at ’E’ beyond climate risk

In the past few years, investors have been trying to align themselves with the Paris Agreement (2015) and scenarios laid out by the Task Force on Climate-related Financial Disclosures (TCFD). Investors have focused on measuring their GHG footprint, aligning investments with 1.5- and 2-degree transition trajectories, and more recently on meeting Net Zero Carbon targets.

More recently, on the environmental side, topics such as biodiversity, water pollution, circular economy have all been gaining more attention.

Social resilience is gaining momentum

In times of COVID-19, and against the backdrop of the ‘Black Lives Matter Movement’ many social (‘S’) issues rose to the fore over the course of 2020.

And with the increasing focus on mental and physical health and wellbeing, the challenges for workers and businesses during this pandemic, as well as with the rising inequalities, calls for social cohesion and for a ‘Just Transition’, social resilience is here to stay.

Better governance of information through harmonisation

Clarity, consistency and comparability of ESG data remain key challenges for ESG investing.

Over the course of 2020, multiple normative standard setters in reporting and accounting such as SASB, IIRC, GRI, and most recently the IFRS, have communicated their commitments to align and standardize corporate ESG reporting efforts.

Globally, ESG index published and maintained by MSCI is widely considered as the most standard and comprehensive set of metrics to be considered.